The Indian Ecommerce Industry today maybe in nascent stage today but has the positive potential of an amplified growth in the near future.It is changing the way businesses are done and sowing the seeds for a whole new economy. Rising incomes and a greater variety of goods and services that can be bought over the internet is making buying online more attractive and convenient for consumers all over the country. The internet is opening up new avenues for the people in rural India which is changing the lifestyles, the quantity and quality of consumption which is helping change mindsets in the rural areas.

A quick glance at the eBay India Census 2012 report indicates that e-commerce is here to stay. eBay Census 2012 research findings were based on an analysis of all online buying and selling transactions by Indians on eBay between July 1, 2011 and December 31, 2012. At eBay India today, every one minute a mobile accessory changes hands and every two minutes a mobile handset. It has 4,306 e-commerce hubs today, of which 1,015 are hubs in rural India, indicating that consumers in the smaller towns of India are a major force in this online growth story.

According to IBEF (Indian Brand And Equity Foundation) The sector is classified into four major types, based on the parties involved in the transactions –

- Business-to-Business (B2B)

- Business-to-Customer (B2C)

- Customer-to-Business (C2B) and

- Customer-to-Customer (C2C)

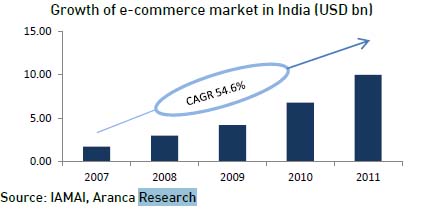

According to an Internet and Mobile Association of India (IAMAI) report, the overall e-commerce market in India has recorded a robust CAGR (Componded Annual Growth Rate) of 54.6 per cent and crossed USD10.0 billion during 2007–11. It is estimated to add another USD4 billion and reach USD14 billion by end-2012. Segment-wise, B2C dominated the sector with a 56.0 per cent share in 2010–11. Together, the B2C-C2C segments have shown significant growth; their aggregate market size stood at USD9.9 billion in 2011, while that for B2B segment was estimated at around USD48.8million. However, B2B’s acceptance is on an upward trend due to its rising awareness amongst Small and Medium Enterprises (SMEs), which are close to 13 million in number.

The United Nations estimates that just 31% of India’s population lives in urban areas, compared to 50% in China, 74% in Russia and 85% in Brazil. As a result, sales from consumers outside of metropolitan areas already make up half of total sales at some leading online retailers in India.

Flipkart today is valued at Rs1,000 crore, and speculation is rife that the e-firm, in fact, is worth at Rs5,000 crore. It recently raised $20 million. Other Indian players – Myntra, Jabong, India Plaza and Junglee – are also eating into the e-commerce pie.

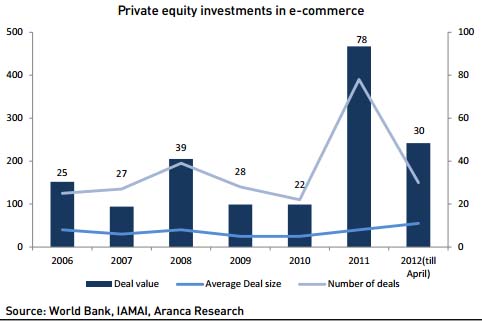

Notably as can be seen in the image below, on the investment front, the sector enjoyed inflow of around USD800 million in 2011, up from USD110 million in 2010. Investments made in e-commerce businesses by PE firms alone more than quadrupled to USD467 million in 2011 compared to USD99 million in 2010. The number of deals increased to 78 compared to just 22 in 2010. The robust deal activity continued in 2012, with USD242 million invested during the January-April period. The trend over the period reflects that the average deal size has more than doubled due to increasing traction in e-commerce activities, which requires larger investments for growth.

However, the major issues which the ecommerce companies face are as follows:

1. The challenge of having a good distribution network but many ecommerce giants are developing their own distribution networks as delivering charges form a major component of the product cost – ranging between USD1.0–4.0 per item.

2. The huge investment made in ecommerce ventures has the potential to give beneficial returns in the long run only if the customer base increases.

3. The turn around time for delivering a product can be reduced to 1-2 days only if the distribution system is improved and this also will help retain old customers and add to the list of new customers.

4. Retaining an existing customer is more profitable for a company since acquiring a new customer; on average costs USD15.0–20.0.

5. Only the ones who can face these issues and retain customers and survive online can get a piece of the pie of the online market as fundamentally weaker companies would lose out to established players . Hence a focus on improving the distribution system and retaining the existing customers is the key to ecommerce success.

On an average day on eBay in India:

According to a study by Forrester , India is expected to record the highest growth in the Asia Pacific region during 2012–16. The trend would shift with the online retail segment contributing equally to the total market size, considering it is expected to grow significantly in the coming years. The B2C segment would continue to lead the e-commerce market, thanks to the budding Indian Internet population, supporting demographics, ease of payment modes and customer-centric innovative policies.

September 15, 2013