On May 9th 2018 Walmart announced that,

Walmart will pay approximately $16 billion for an initial stake of approximately 77 percent in Flipkart.

The remainder of the business will be held by some of Flipkart’s existing shareholders, including Flipkart co-founder Binny Bansal, Tencent Holdings Limited, Tiger Global Management LLC and Microsoft Corp.

While the immediate focus will be on serving customers and growing the business, Walmart will support Flipkart’s ambition to transition into a publicly-listed, majority-owned subsidiary in the future.

About FlipKart:

Founded in 2007, Flipkart has led India’s eCommerce revolution. The company has grown rapidly and earned customer trust, leveraging a powerful technology foundation, including artificial intelligence, and emerging as a leader in electronics, large appliances, mobile and fashion and apparel.

In 2015 FlipKart had adopted an App only strategy and had shut down their website. But, they found it difficult to provide an efficient user experience and soon shifted to a website which combined the benefits of the App and website and called their Progressive Web App as FlipKart Lite.

The FlipKart PWA resulted in :

- 3X more time spent on site

- 40% higher re-engagement rate

- 70% greater conversion rate among those arriving via Add to Homescreen

- 3X lower data usage.

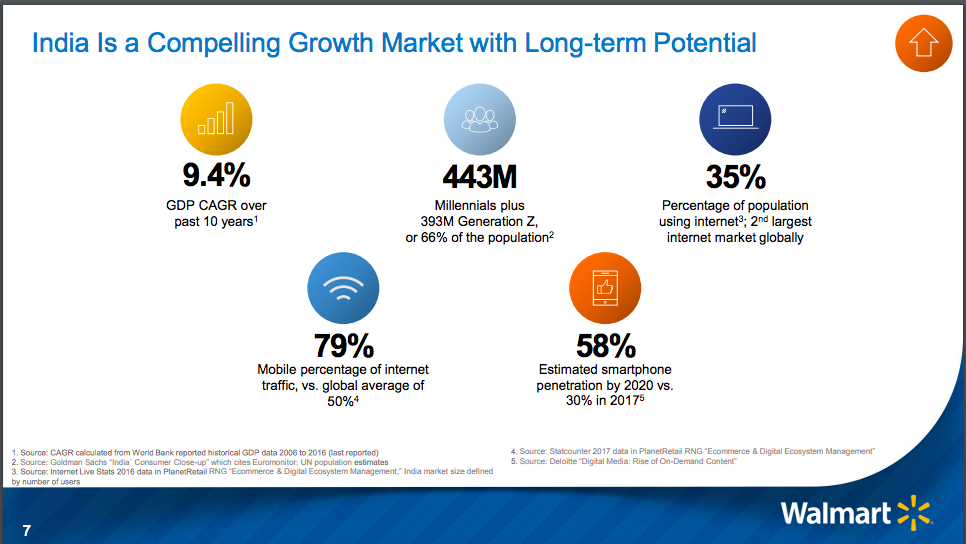

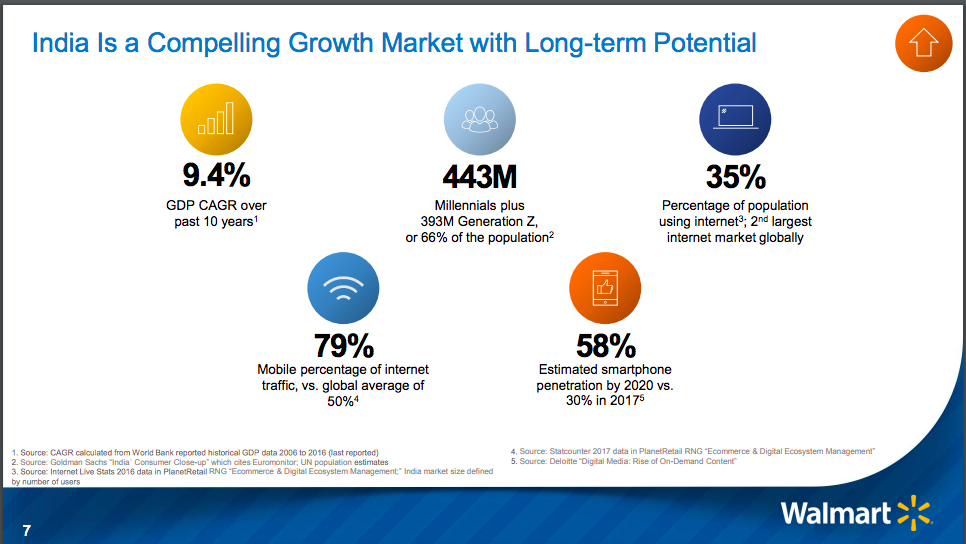

Some Major Commercial Reasons Walmart shared in their Investor Presentation are:

- "India is one of the most attractive retail markets in the world, given its size and growth rate, and our investment is an opportunity to partner with the company that is leading transformation of e-commerce in the market," Walmart CEO Doug McMillon said in a statement.

- Flipkart has 54 million active consumers, and with this influx of money it can double this base in short period of time.

- Walmart commits to sustained job creation and investment in India which is one of the largest and fastest-growing economies in the world.

- Flipkart’s supply chain arm, eKart, serves more than 800 cities, making 500,000 deliveries daily.

- “Flipkart has established itself as a prominent player with a strong, entrepreneurial leadership team that is a good cultural fit with Walmart,” said Judith McKenna, president and chief executive officer of Walmart International.

- Over the last 10 years, Flipkart has become a market leader by focusing on customer service, technology, supply chain and a broad assortment of products.

- Walmart’s investment includes $2 billion of new equity funding, which will help Flipkart accelerate growth in the future.

- While Walmart and Flipkart will leverage the combined strengths of both companies, they will maintain distinct brands and operating structures.

The FlipKart – Walmart deal surely scales a major success graph for the Indian eCommerce start-up but, it also passes on the control of the online retail business in India to two large American companies – Walmart and Amazon.

Soon after this announcement Amazon is said to be in talks with India’s largest brick-and-mortar retail company Future Retail, to acquire a stake.

Future Retail is the retail arm of Kishore Biyani. Future Group, owns physical retail stores such as Big Bazaar and Easy Day.

“Future has consolidated the market. There are only three big retailers left: Reliance Retail, D-Mart and Future Retail… Future is an attractive target,” said Abneesh Roy, senior vice-president (research) at Edelweiss Capital.

Roy added that Future and Amazon can be of use to each other. For example, Future Retail can learn from Amazon’s global sourcing business. On the other hand, Amazon in India can take the help of Future’s supply chain. Future Group has a fully-owned subsidiary called Future Supply Chain Solutions. It has a network of 46 distribution centres, which includes four temperature-controlled centres — spread out in a ‘hubs and branches’ model, covering 11,228 PIN codes.

May 24, 2018